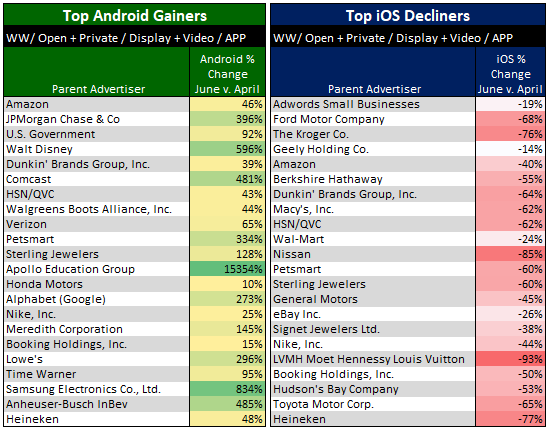

Advertisers Move Spend To Android

/Advertisers Move Spend To Android While iOS Revenue Declines

With the continued adoption of iOS 14.5+, we’ve begun to see a trend of advertisers moving more of their spend to Android and away from iOS. Amazon, Dunkin', Booking, and Heineken have each made significant shifts, increasing Android spend by 20-50% and decreasing iOS spend by 40-80%. It's likely these advertisers may be targeting Cookies rather than specifically targeting Android users. But regardless, it’s a trend we’ll continue to follow and report on as buyers evolve how they track users.

At A Glance:

Displaying the fastest growth on Android, in just the last month Walgreens is up 128%, Lowe's is up 400%, and Petsmart is up 710%.

Since April, the Travel category is up 10% on Android and down 40% on iOS, and Computers & Electronics is up 30% on Android and primarily flat on iOS.

We also observed advertisers outside of this list who decreased spend on both Android and iOS, implying they may be avoiding mobile inventory completely. We'll share updates if this trend continues.