Fashion Tip: Slippers Out, Sneakers In

/Advertiser Data: Biggest Movers

Week 42 displayed a steady increase in CPMs that continued from last week. Some categories stood out this week. Beauty & Fitness are up significantly this week, and Pharmacies saw a bump from in-person healthcare and the flu shot.

*As the election nears, we are interested in if/how advertiser strategies will be impacted. Thus far we’ve heard some advertisers may pause close to the election. They may also choose to avoid election specific content. We would love to know if you’ve heard about any plans shifting around the election. Please submit your response here, and we’ll share the responses next week.

For direct access to your BMX dashboard contact your company Admin or reach out to Support@staq.com

At A Glance:

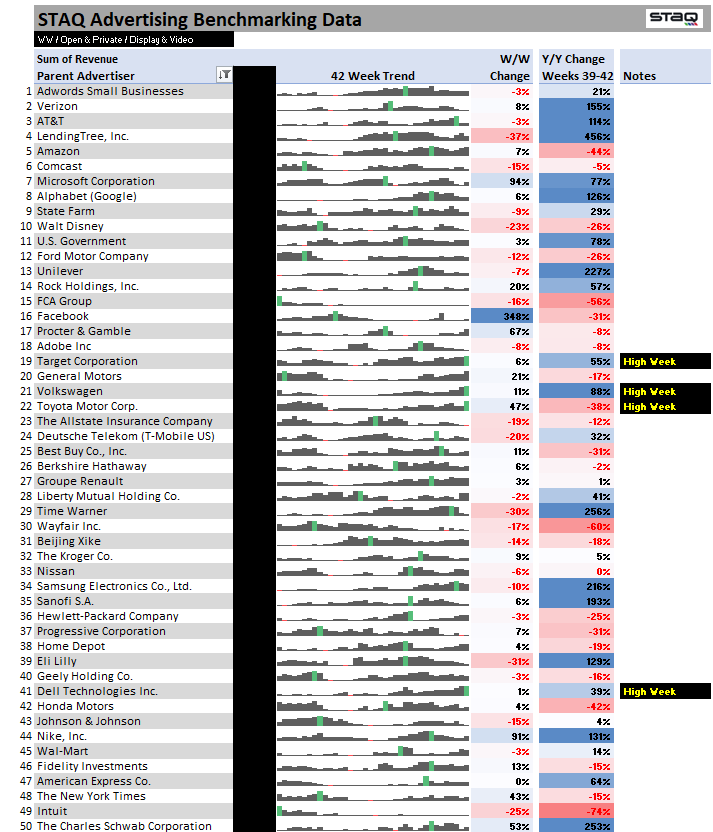

Sneakers on Zoom. A welcome pop this week from Apparel and Retail who had their highest week of the year. They are led by The Gap, Adidas, and Nike up 90% W/W.

Vehicles continue to significantly increase with 3 of the Top 50 Auto advertisers up double digits W/W. VW and Toyota (up 50%) both had their highest spending weeks of 2020.

Entertainment down 30% this week. With big budget theatrical releases pushed to 2021, advertising increases in this category will be dependent on streaming services. Note: Be on the lookout for long awaited Coming 2 America to be released on Amazon on Dec 18. (Someone at STAQ is particularly excited about this one)

Below is a view of the top 50 advertisers, based on spend. The right column compares Y/Y trends of the 4 week average of Weeks 39-42 2020 vs 2019. The left column compares W/W trends from Week 42 vs Week 41.

The Grand Total represents the entire Advertiser dataset.