Q3 Prospecting Report

/Get Ahead In Q3:

A Look At 2019 Top Q3 Advertisers

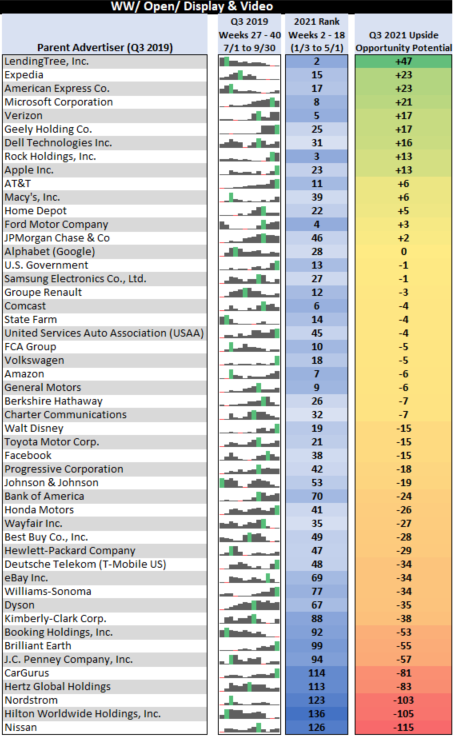

We’ve pulled a list of the Top 50 spenders from Q3 2019 (reminder of the consensus that 2020 is an impractical comparison for 2021). We hope you find this helpful in identifying potential opportunities in the coming quarter.

As a valued Benchmarking partner, if your data is available, you will also receive a more detailed custom report that includes your share of the top advertisers’ Q3 2019 spend. Here's to a successful Q3!

**The green bar represents the advertiser's Peak Revenue Week

This chart represents a typical mix of Q3 advertisers and a good indication of those likely to spend heavily this year. Some advertisers here like in Travel, are still emerging from covid related decreases and continue to pick up momentum W/W. Additionally, there are advertisers absent from this list that we've seen significantly increase spend in 2021, and may be poised to continue into Q3.

New To The Top 50 In 2021:

Discovery: 102 --> 16

Capital One: 88 --> 20

Adobe: 56 --> 24

Uber: 51 --> 30

Qurate Retail --> 69 --> 36

LVMH: 80 --> 37

Viacom: 176 --> 40

Metlife: 129 --> 44

At A Glance:

Keeping it streaming, Entertainment advertisers displaying some of the largest new opportunities (over 2019) with Viacom up 136 spots to #40, and Discovery rising 86 spots to #16.

Making steady W/W gains over the last 4 weeks, AmEx rose to the #17th spot, and CapOne gained a significant 68 places over 2019 in the #20th spot.

Dell has shown steady W/W increases since January, rising to the #31st spot. Microsoft has been a consistent spender since Feb, gaining 21 spots over 2019 to the #8th spot.