Christmas In July For Desktop CPMs

/Desktop CPMs Rising Like It's Christmas 2019, While Impressions Hit A 3-Year Low

As the US opens back up and consumers spent more time on mobile devices, Desktop inventory has dropped 25% since Q1, while CPMs have grown exponentially.

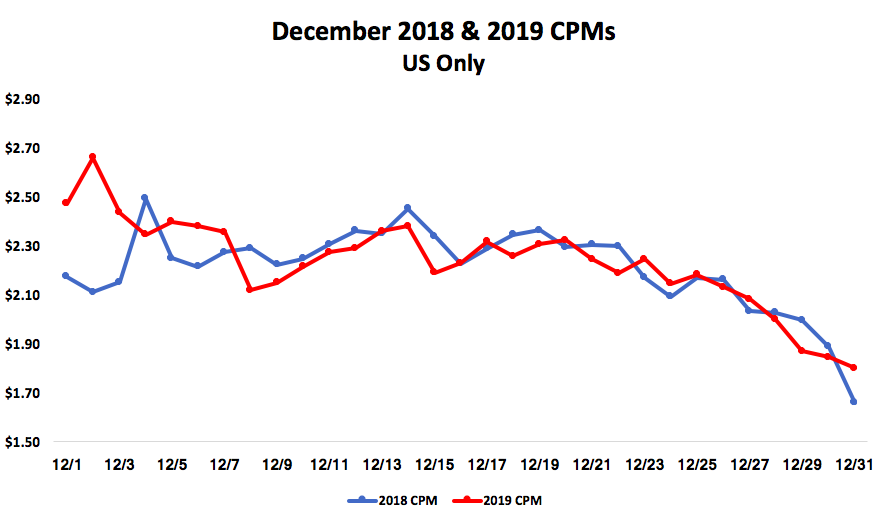

Since April, Desktop CPMs have grown 3% each week, reaching levels we haven't seen since Holiday 2019.

We'll see if this trend continues into the rest of the summer and Q3.

At A Glance:

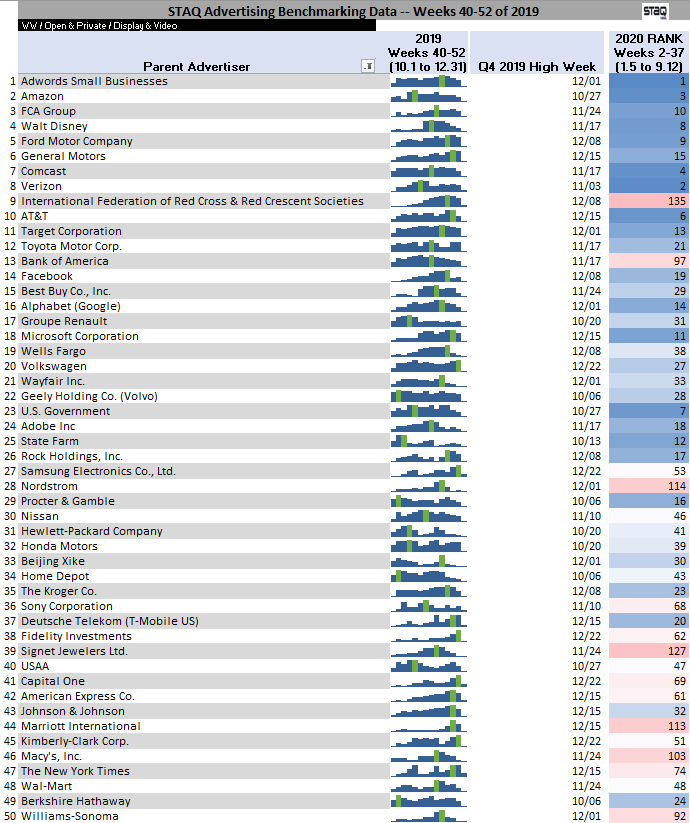

The Open market is behaving as expected as apparent Desktop scarcity drives rising CPMs, up 17% from Q1 and reaching their highest levels since Q4 2019.

Pro Tip: Despite Google delaying their Cookie deprecation, its important to start looking deeper into device trends at the browser level in order to identify opportunities to improve your CPMs. We'll keep you updated with our analysis.