We Have A New View On Advertiser Spend

/It's a break out week for Transaction Types. We are excited to share new cuts of data that provide you and your teams a more granular understanding of Advertiser spending and CPMs in the Private and Open Markets.

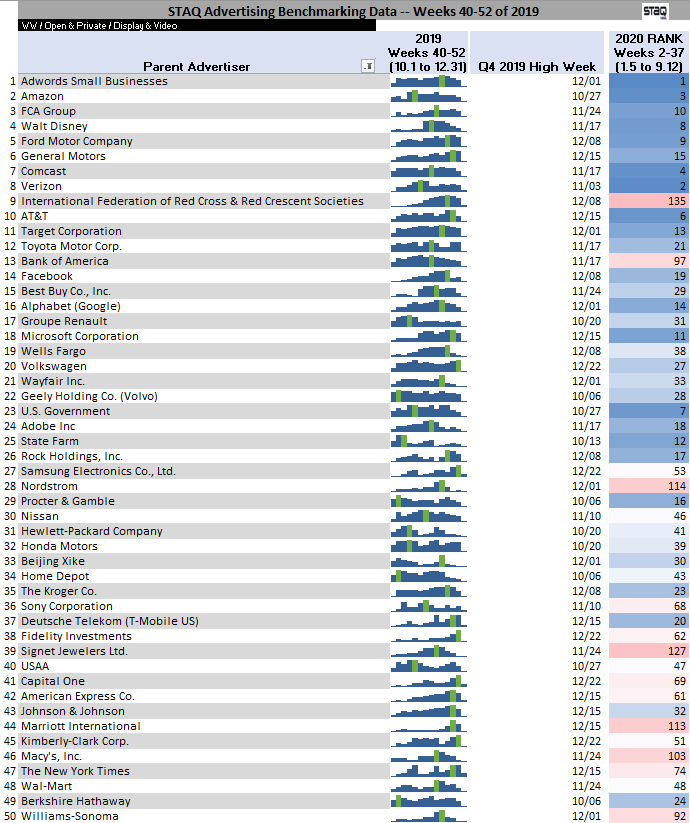

We are sharing Q4 data to familiarize you with the data and act as a baseline. Included are the Top 20 Advertisers in Q4 2020. We observed their different programmatic strategies based on spend distribution across Transaction Types (Open, PD/PA, and PG). As the variability between Private and Open from Quarter to Quarter becomes clear, we'll share those insights with you.

You can access this data and a more detailed breakout on all advertisers in your Benchmarking Dashboard. Reach out to your Account Manager for any questions or a demo.

Advertiser Rev Share By Transaction Type

At A Glance:

9 of the Top 20 Q4 advertisers had 70%+ of their revenue share in the Open Market vs Private Channels. Most reliant on Open was LendingTree at 96%, and Best Buy at 92%.

Retailers Target and Wal-Mart both spent the most via PD/PA. However in Mobile, AT&T utilized PD/PA the most, while Verizon favored Open, followed by PG.

Advertiser CPMs By Transaction Type

At A Glance:

Wal-Mart and State Farm CPM's in PD/PA were <$1 higher than Open

However, HP and Ford's PD/PA CPM's were ~$9 higher than Open